Part II: The Biosecurity Solution Space and Potential for Venture-Scale Businesses

In our prior 18+ months of research within biosecurity we have continued to build a framework for how venture-scale businesses could exist to address this impending and underappreciated problem space. In Part I, we detailed why a cutting edge biosecurity firm should rise to meet the threat we face from natural pandemics and from the increasing power and democratization of biotech. In Part II, we categorize the solution space of biosecurity into pre-infection (preventative) and post-outbreak in order to simplify this framework for where in the given “stack” a company may sit.

Below we’ll lay out high levels of these views, however our internal research has led to a collection of very clear ideas on where building within biosecurity makes sense. We’re happy to discuss deeper thoughts and ideas with potential founders in the space. We believe there are multiple venture scale businesses to be built in biosecurity and likely this will only expand over time as the ecosystem does as well.

Pre-Infection Prevention

Pre-infection biosecurity is a broad area which can encompass anything from norms and customs around publishing sensitive research, screening buyers and their orders, to physical infrastructure to make our built world antibacterial and antiviral.

While upgrading our physical infrastructure to stop viral transmission before it starts is among the most effective solutions to the threats faced, it generally must be led by the public sector as it has no hallmarks of a viable private business.1 Thankfully, FROs are spearheading research in the most promising solutions.

In comparison, we’re excited by the both distinct and overlapping opportunities in bioscanning and norms/customs to build the Palantir of biosecurity, with value accruing in the next 1-3 years.

Such a company could integrate across the various choke points into one always-on security system with features that include those below. Additionally, certain governmental regulation would accelerate this future.2

Such an integrated biosecurity provider would enjoy a network effects driven positive feedback loop. The bioscanning company with the best, most detailed data would also be able to predict fastest and with highest accuracy and precision where pathogens may emerge from next, its pathogenicity and its evolutionary landscape. This would secure the most lucrative data packages for drug and diagnostics development and for spatially-targeted advertising. It would also inform where to deploy further sequencing resources most effectively to dynamically increase coverage in those areas.

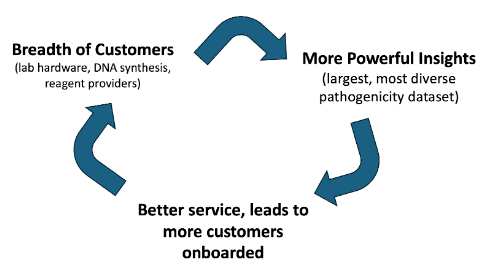

For norms/customs platforms, the breadth of their customer base becomes the company’s core network effect, with more powerful insights with each onboarded customer. This is because the biosecurity provider is able to piece together orders from across companies and ascertain whether the aggregate of the products could be dangerous. Once a system like this is established, there becomes incredibly high switching costs and an entrenched incumbency dynamic.

There is some credence to the idea that there might be pushes for this entity to be a federal body, but if private actors move quickly and are using the most sophisticated monitoring techniques, one government won’t own it. We’ve spoken with insiders at government screening agencies who say they only actively scan for a few main pathogens and don’t employ cutting edge sequencing technologies or tracking techniques.

Put simply, microbes don’t have borders so biosecurity tools shouldn’t either. By extension we believe a biosecurity company built here should, by definition, be servicing international companies.

The complexity is that a commercial third party has to continually justify its raison d'etre by providing significantly better products than what’s open-sourced or available from competitors. We envisage this creating a sort of ‘safety race’ (instead of arms race) with SOTA bioscanning and norm/customs.

Moreover, to make this investment in ever-better biosecurity infrastructure economically sustainable without relying on the occasional pandemic, we anticipate selling the real-time data to drug and diagnostics developers as well as the healthcare system for targeted outreach to high-risk individuals.

Post-Infection Treatments

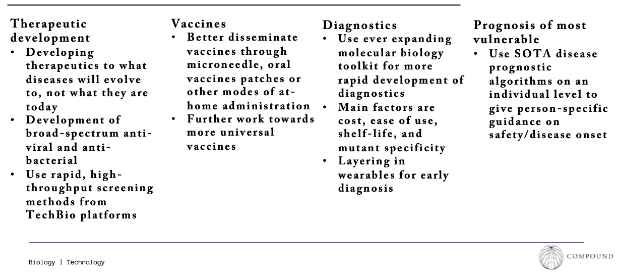

Preventative work can only take us so far. There are infections which may escape the best screening tech or come from contact events which aren’t monitored. Regardless of how or where the disease emerges there are four prongs of innovation which can endeavor to keep us safe - therapeutics, vaccine delivery, and diagnostics. We think there’s more distinct opportunities here for founders and companies that could be built in all three verticals.

One positive of COVID is it triggered a technological revolution in vaccines and antivirals, forcing these previously less invested in modalities to integrate the cutting edge. That has continued on as companies like Moderna have expanded their now de-risked vaccine technologies into every infectious disease, estimating their TAM at $57B.

The frontier of development currently includes mRNA, self-amplifying mRNA, circular RNA, broad based or universal vaccines and antivirals, adjuvants, precisely patterned nanoparticles, and tissue-specific delivery. For context on the breadth of these advancements, there are 219 universal vaccines in development and 40 in clinical trials. Look at CEPI’s portfolio, GVA’s technical reports, GHIC, Adjuvant, or the Gates’ Foundation for a comprehensive list of ideas pursued.

Strides have also been made towards the easiest possible vaccine administration: a cheap shelf-stable version shows up at your door that can be painlessly self-administered. The most promising tech, microneedle array patches, are $1 patches not unlike nicotine patches with an array of 100s-1,000s of tiny needles each smaller than a human hair. They activate the immune cells in the skin, so they don’t penetrate deep enough to trigger nerve cells and therefore pain. Manufacturers are at mass production scale and have had successful clinical trials. These, among other technologies in development, would drastically increase compliance.

Finally, synthetic biology tools have been utilized to rapidly produce diagnostics for incredibly low cost (e.g. $5 paper-based cell free diagnostics with qPCR accuracy, single tests diagnosing a range of viruses).

An Ambitious Vision for a Biosecurity Company

Putting this all together, the most ambitious, cutting-edge company could build the most comprehensive bioscanning infrastructure integrated across the various physical and digital chokepoints and then harness that unparalleled real-time dataset to become the foremost expert in predicting and designing drugs around evolutionary landscapes.

Many of the recent pandemics emerged from known viral and bacterial lineages which means that pre-emptive therapeutic development is plausible and valuable. The company could employ the latest research in predicting viral evolution and escape, and then design a broad-based drug optimized for the common denominator across the distribution of possible evolutionary paths. After proving this concept out in infectious diseases like the flu and RSV, the company may even be able to expand to antibiotic resistance, malaria, tumors.

An Inevitable Future

Many people surrounding biosecurity continue to doubt its ability to be both venture-scale and to operate on timelines that are persistent versus spikes of catastrophes such as COVID-19. We believe this is short-sighted.

Instead, momentum continues to build at critical political mass. While government entities have long recommended the legal requirement of sequence and customer screens, a recent series of Executive Orders requires “the development of a framework to screen nucleic acid synthesis and makes procurement from companies that screen a condition of federal research funding” as well as promised measures to protect against AI being used to engineer dangerous biological material. Additionally, earlier this month, the White House dramatically expanded the list of viruses under regulatory oversight for gain of function research from 12 to 68, with some requiring federal approval to work on. More speculatively, we expect all biotech and agriculture companies to eventually be required to detail their efforts to mitigate biosecurity threats and publicly disclose any compromises, just as a recent SEC ruling mandated that all public companies do so for cybersecurity / IT threats. Finally, an imminently-doable regulatory unlock would be the development of an objective function algorithm to benchmark sequencing algorithms against – because politicians don’t want to mandate security measures that they can’t measure.

We have conducted many interviews with leaders in the government sector and confirmed that there’s a political consensus building.

We believe there’s no better time to start a biosecurity company. We’re just emerging from the most severe and most public-facing biosecurity threat in a century, have strengthening regulatory tailwinds, and a demonstrable current need that’s growing nonlinearly with biotechnology broadly.

Across a variety of government-adjacent areas, multiple large venture backed businesses have been built at times where it felt both early but inevitable that the private sector must take charge. We believe biosecurity will be no different, however unlike other areas, the stakes could be far higher and the customer base could be far more diversified than other government-centric companies.

We've held this belief for many years and are now excited to share our work publicly and privately with prospective builders for the next generation of biosecurity. Feel free to email us to chat further.

Footnotes:

[1] Promising PP&E:

- Most promising: Far UVC (R-Zero, LumenLabs), PAPR, fog machines, HVAC, N95 stockpiling

- Other: Poppy and IAQ Sensor (air cleanliness testing & detection of airborne pathogens), Safetraces (assessment of building’s PP&E), ByoPlanet (handheld disinfecting electrostatic sprayer at atomization quality), AllClir (tests whether a surface is disinfected), Optisolve (live imaging of microbes on surfaces), Hygiena (handheld sample tester for cleanliness), variety of GBAC-certified disinfectants (1,2,3,4), BioFlyte (mass spectronomy-based pathogen detector)

- Metamaterials (sprays, sealants, etc.) designed to make surfaces continually sterile: Ad Rail’s GBAC seal for escalator handrails, Nano Care’s spray-on coating, recent paper on superhydrophobic surfaces with microstructures for sterilization

[2] Regulatory and norms/customs unlocks for biosecurity

- Adjusting the academic culture away from publishing freely the details of the most dangerous pathogens. Maybe it becomes confidentially shared amongst confirmed virology labs? Maybe there's a confidential GitHub-esque service to be built? Maybe there’s an automatic scraping mechanism employed by bioarxiv and other outlets which flag potential new pathogens?

- Establishing capped financial liability policy for labs that accidentally leak a pathogen, which would enforce accountability and enable insurance markets.

- Objective function algorithm / benchmark to test efficacy of screening mechanisms. This would be a meaningful regulatory unlock, as politicians don’t want to mandate biosecurity measures that aren’t measurable.